Assessing the Impact of E-CRM On Customer Loyalty: The Moderating Role of Service Quality

Maryam Ahmad

Department of Management Sciences, National University of Modern Languages, Islamabad, Pakistan.

Dr. Farhina Hameed

Faculty of Management Sciences, National University of Modern Languages, Islamabad, Pakistan. 0000-0002-1109-3279

Ahmad, M., & Hameed, F. (2025). Assessing The Impact of E-CRM on Customer Loyalty: The Moderating Role of Service Quality. (2025). Kashf Journal of Multidisciplinary Research, 2(02), 15-31. https://doi.org/10.71146/kjmr272

Abstract

The study examines the impact of Electronic Customer Relationship Management (e-CRM) on service quality and its subsequent effects on brand

image and customer loyalty within the banking and retail sectors, using data from branches of Al-Falah and MCB Bank in Islamabad and Rawalpindi.

Employing a quantitative research methodology, the study collected data from 300 customers using a structured questionnaire based on validated scales. The

research specifically inspected whether improved service quality mediated by e-CRM enhances brand image and how this, in turn, influences customer

loyalty. The study also examines the mediating factor of consumer satisfaction serving in these relationships. Preliminary findings indicate that

effective e-CRM implementation significantly enhances service quality, which positively affects the brand image and strengthens customer loyalty,

particularly when consumer satisfaction is high. The paper highlights the importance of integrating e-CRM into customer service strategies to boost

customer perceptions and create loyalty, offering valuable theoretical and practical implications.

Keywords:

E-CRM, Brand Image, Customer Loyalty, Customer Satisfaction, Banking, Brand

Reputation, Banking Sector, Service Quality, Customer Perception.

Introduction

In the constantly changing world of e-commerce, e-CRM has become a vital technology for the improvement of customer relations and the delivery of high-quality services. Lu, Papagiannidis, and Alamanos (2020) state that e-CRM’s combination of advanced data analytics and customer interaction tools is the key to the personalized services that meet the increased consumer expectations of today. This technological breakthrough greatly improves the quality of customer service interactions in online settings, thus, making customer relationships better.

The success of e-CRM in improving service quality directly affects the creation of a positive brand image. Ngo, Nguyen, and Cao (2021) show that in the banking sector, the perception of higher service quality mediated by e-CRM results in a better brand image. This mediation highlights the importance of e-CRM in not only fulfilling but also surpassing customer service expectations, which in turn creates a positive brand image among consumers.

This positive brand image is important for creating customer loyalty, which is the main cause of long-term business success. Chen and Huang (2022) stress that in e-commerce environments, a strong brand image considerably increases customer loyalty, which in turn, causes behaviors such as repeat purchases and positive word-of-mouth. The link between a positive brand image and customer loyalty is even more solidified by consumer satisfaction which serves as an important moderator. According to Tajvidi, Richard, Wang, and Hajli (2020), in social commerce, the satisfaction consumers get from the brand they interact with greatly increases the impact of a positive brand image on their loyalty. Hence, comprehending the intricate relationship among e-CRM, service quality, brand image, customer loyalty, and consumer satisfaction is more important than ever for businesses that want to succeed in the digital marketplace. Through the strategic use of e-CRM to enhance service quality, companies can successfully create a positive brand image, which in turn will result in customer loyalty when combined with high levels of consumer satisfaction. This thorough method makes sure that businesses not only get but also keep a loyal customer base in a digital environment that is full of competition.

Although recent studies have examined the effects that e-Customer Relationship Management (e-CRM) systems have on brand loyalty such as the work of Ngo, Nguyen, and Cao (2021). This paper has investigated the mediation role of service quality between e-CRM and brand image. There are many theoretical gaps especially related to Pakistan. No such studies have been done here. In addition, especially in the banking sector, it calls for more research.

Research Objective

• To measure the direct effect of e-CRM on brand image, customer satisfaction, and customer loyalty.

• To analyze the moderating effect of service quality in the relationship between e-CRM and positive brand image.

• To measure the mediating effect of brand image in the relationship between e-CRM and customer satisfaction.

• To measure the mediating effect of customer satisfaction between brand image and customer loyalty.

Research Questions

• Does e-CRM have a direct effect on brand image, customer satisfaction, and customer loyalty?

• Does service quality have a moderating effect on the relationship between e-CRM and positive brand image?

• Does the brand image have a mediating effect on the relationship between e-CRM and customer satisfaction?

• Does customer satisfaction have a mediating effect between brand image and customer loyalty?

Theoretical Implications: The study of the direct effects of e-CRM on service quality contributes to the theoretical frameworks of e-CRM functionalities and their effectiveness in service-oriented industries like banking. This gives empirical evidence to the discourse on how the technological enhancements in CRM systems influence customer service processes and outcomes. This research makes it clear that service quality is a mediator and customer satisfaction is a moderator in the relationship between e-CRM, brand image, and customer loyalty. These integrated models help in dividing the pathways and conditions under which e-CRM affects the long-term customer attitudes and behaviors, hence, giving a more detailed explanation of these relationships. Through the banking sector, the research provides information that can be compared with the other sectors. Thus, it is possible to get a wider knowledge of how industry-specific factors affect the effectiveness of e-CRM systems and this may lead to cross-sectoral theoretical generalizations. Practical Implications: The real-life impact of this research is vast for banking personnel, policymakers, and e-CRM solution developers. Banks could use the findings to improve their e-CRM strategies, focusing on the quality of service that affects the brand image and customer loyalty the most. The specificity of this method will allocate resources more efficiently in customer service technologies. The understanding of how a positive brand image and high consumer satisfaction of the customers are the key influences that make them loyal to the bank can help banks design more effective loyalty programs. Gaining the knowledge of the relationship between these two items will help to design the customers’ experiences which are more individualistic and which will create the customer’s loyalty. The banking sector is highly regulated, so, the banks can make sense of how e-CRM can be modified to fit into the regulatory requirements while at the same time, improving the service quality of the banks, thus, maintaining compliance and the customer’s trust. Banks can use these findings to push for the development of legislative measures that will encourage innovation in customer relationship management. The outcomes of this paper can be applied to develop training programs for customer service representatives in banks, and it should be centered on the use of e-CRM tools which heighten service quality and as a consequence, the brand image and loyalty. The study offers the basis for the service quality and customer satisfaction levels that banks can use for comparing their performance with the industry standards. Benchmarking can be used as a competitive edge in the marketing as well as in the operational strategies. In general, this study has both theoretical and practical implications in academic circles and also gives solutions that are practical for the business sector in the banking sector, customer satisfaction, and competitive advantages through the effective use of e-CRM systems. Problem Statement: In the banking sector, the effective use of Electronic Customer Relationship Management (e-CRM) systems is very important for the improvement of service quality and customer relations. Nevertheless, the difficulties in completely achieving the advantages of e-CRM technologies in enhancing brand image and customer loyalty are still present. Research shows that although e-CRM can greatly improve service quality, this improvement becomes a mediator in the creation of a good brand image (Ngo, Nguyen, & Cao, 2021). Apart from that, the relationship between a good brand image and customer loyalty is complicated by the different levels of customer satisfaction, which is the factor that moderates this relationship (Chen & Huang, 2022). These results show that there is a lack of knowledge on how e-CRM tools can be made to work in the banking context to meet the regulatory demands and customer expectations for personalization and security, hence the need for sector-specific research that would address these unique challenges.

Literature Review

e-CRM is a very important tool in the digital transformation of customer service, especially in sectors such as banking where customer engagement and satisfaction are the key. The study by Lu, Papagiannidis, and Alamanos (2020) shows that e-CRM uses data analytics and interaction tools to deliver personalized customer service, which in turn, improves customer satisfaction and operational efficiency. The change towards the more technologically advanced CRM systems makes businesses not only meet but also anticipate customer needs, thus, creating a deeper relationship through better responsiveness and personalized interaction. In addition, Lee and Lee (2020) found that the use of e-CRM systems has been

proven to be able to efficiently manage customer data and interactions across different digital platforms, thereby, making the processes that contribute to the better quality of customer service and customer retention rates.

Nevertheless, the introduction of e-CRM and its influence on brand image and loyalty leaves a mixed impression, which means that the mere adoption of e-CRM technologies may not be enough to reach the desired goals. Ngo, Nguyen, and Cao (2021) present that e-CRM can increase the degree of service, but the level to which this induces enhancement of the brand image is exceedingly reliant on how the consumer perceives these enhancements. This perception is very important as it is the connection between the quality of service and brand image in the banking sector. At the same time, the research by Chen and Huang (2022) demonstrates the intricacy of this connection, presenting that consumer satisfaction significantly moderates how a positive brand image derived from e-CRM implementation influences customer loyalty. These findings express that the need for a comprehensive and integrated approach to the e-CRM implementation is present, which means that brands must not only focus on the technical adoption but also on how these technologies are merged into the customer service process to enhance customer perceptions and thus brand loyalty.

A particular emphasis has been put on the role of service quality in the context of enhancing the level of customer satisfaction and loyalty, especially considering the current tendencies of the rapid rise of consumer expectations due to digitalization. The research by Kim and Park (2021) indicates that high service quality in the form of the reliability, responsiveness, and personalization of services results in increased customer satisfaction with the services and hence, enhanced customer retention rates. This connection underlines the fact that service quality contains not only the short-term aspect, which is customer satisfaction but also the long-term perspective that can be seen as customer loyalty, especially in the contexts of highly competitive industries such as retail and hospitality. Furthermore, Hossain et al.

(2020) focused on the dimensions of service quality in the online service environment, and they indicated that system quality, information quality, and service encounter quality were the variables that impacted customer perception and satisfaction. These dimensions therefore lead to loyalty especially if the customer feels that he or she has been understood and the service provider has met the needs of the customer.

Besides, the mediation role of service quality between technological innovations and customer loyalty has been recognized. For example, Zhang, Li, and Liu (2020) studied how improvements in technology, when applied to increase service quality, can greatly influence the relationship between technology use and customer loyalty in the banking sector. Their research shows that the way technology improves service quality is what makes customers loyal, not the technology itself. This view is supported by research conducted by Zhao et al. (2021), which investigated how service quality bridges the gap between e-CRM capabilities and customer loyalty in the telecommunication industry. The study proved that superior service quality which is accomplished through the effective use of CRM systems has a strong effect on customer satisfaction and loyalty, thus, service quality is a vital mediator in the technology customer loyalty linkage. These studies together show that service quality is no longer only a factor that influences customer satisfaction but also an essential mediator that increases the benefits of technological advancements in the service industries. Brand image is the consumer’s frame of reference of a brand as the image that exists in the minds of the consumers. The brand image assists the customer in identifying his/her needs that connect with the brand and gives a clear insight into the operational manner of achieving the need fulfillment through the brand (Hossain, 2020). Brand image is the mental picture that a consumer forms in his/her mind when he/she thinks about a certain brand. The association can be as simple as a thought or an image that can be linked to a brand The image of the brand is in the form of an attitude that includes beliefs and preferences about a brand. This makes sense since consumers who have a good impression of a brand will be more

likely to buy the product. Consumer experience impacts the formation of the brand image.

The latest research stresses the essential role of brand image in the current competitive market landscape and shows how it influences consumer behavior and loyalty in different sectors. Kaur and Quareshi (2021) show that a powerful, positive brand image not only improves customer perceptions but also has a great impact on their purchasing decisions and loyalty intentions. The relationship is especially evident in sectors where brand differentiation is the main factor that the consumers choose, such as in the fashion and technology industries. Besides, the dynamic effect of digital marketing on brand image has been the main topic of research, with Tang et al. (2020) proving that digital marketing efforts can elevate

brand image by engaging customers through multiple digital channels. The results show that the smart use of social media, content marketing, and online customer interactions can greatly increase the perceived value of a brand, thus the customers will be more attached to the brand and loyal.

Besides, the importance of brand image in the reduction of negative publicity or consumer skepticism has been pointed out by Zhu and Chen (2020), who discovered that a strong brand image can be a kind of shield, keeping customer trust and loyalty even in times of crisis. These studies altogether show that brand image is not only a superficial part of marketing, but a vital, strategic asset that affects consumer trust, engagement, and loyalty at different situations and touchpoints (Hameed et al. 2023). Customer satisfaction is still the main factor of organizational success since it is the measure of

consumer’s perceptions and intentions. The latest research, for example, those by Sharma and Nayyar (2020), underlines the significance of recognizing the subtle factors that are responsible for customer satisfaction in the digital era. Their study focuses on the fact that online service quality, such as responsiveness, website design, and personalized customer service, directly affects the level of customer satisfaction. This is especially important in the e-commerce sector, where the quality of digital interactions is a major factor in the creation of consumer experiences and the resulting satisfaction. Besides, Bala and Verma (2020) examined the effect of the perceived value which is the quality versus cost assessment made by the consumers, on their satisfaction. They discovered that when consumers feel that the service or product has high value, their satisfaction levels are greatly increased, which results in better retention rates and word-of-mouth promotion.

Besides, the function of customer satisfaction in the way it bridges the gap between service or product quality and customer loyalty has been widely studied (Hameed, 2013). For instance, Zhang, Xue, and Cao (2021) shed light on the mediation role of satisfaction in the tech industry, where product innovations and service enhancements are the main factors that increase customer satisfaction, which consequently leads to customer loyalty. The mediating role of customer satisfaction in this process proves its importance as a strategic lever in the conversion of quality improvements into loyal customer behaviors.

Moreover, the effect of customer satisfaction on repurchase intentions has been studied by Kim and Kim (2020), who found out that satisfied customers are more likely to buy the same product again and to tell other people about the brand, thus, the importance of keeping high satisfaction levels across all customer touchpoints is increased.

Customer loyalty is still an important issue for businesses that want to be successful in the longterm, especially in the face of increasing competition and changing consumer tastes. The latest studies,for example, the one by Chen and Huang (2022), prove that brand image is the key element in the creation of customer loyalty. They show that a good brand image greatly improves customer loyalty and commitment, especially in e-commerce environments where there is a lot of competition and customers have many options. Besides, the significance of emotional attachment and perceived brand value as the main factors of customer loyalty has been studied by Li and Wang (2021), who discovered that stronger

emotional connections with a brand result in higher customer retention and advocacy. This emotional investment creates a barrier to switching behavior, which proves the complicated relationship of emotional factors in customer loyalty dynamics.

Besides, the mediating role of customer satisfaction in the connection between service quality and customer loyalty has been a major area of interest. For example, Kaur and Sharma (2020) showed that higher service quality results in higher customer satisfaction, which then increases loyalty, especially in service sectors like hospitality and retail. This mediation shows that the improvement of service quality is a good strategy for the cultivation of loyalty through enhanced customer satisfaction. The study by Ngo, Nguyen, and Cao (2021) also emphasizes the significance of combining electronic Customer Relationship Management (e-CRM) tools to maintain customer loyalty, which shows that advanced e-CRM systems

that provide personalized experiences and efficient service increase customer satisfaction and, thus, the loyalty. These results underline the necessity of smart investments in quality service delivery and relationship management technologies to build and keep a loyal customer base.

Hypotheses

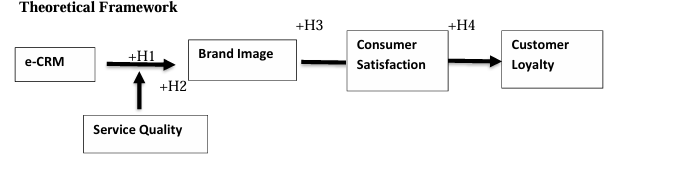

H1: e-CRM has a direct effect on brand image, customer satisfaction, and customer loyalty.

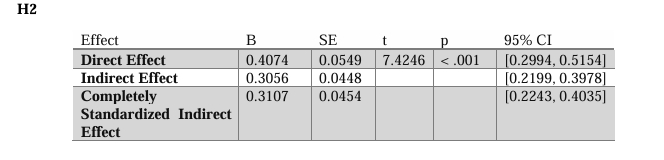

H2: Service quality has a moderating effect on the relationship between e-CRM and positive brand image.

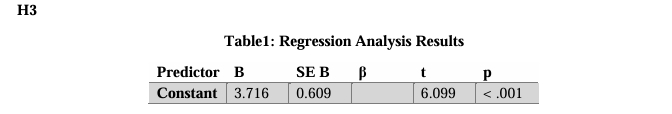

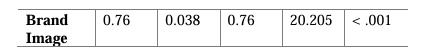

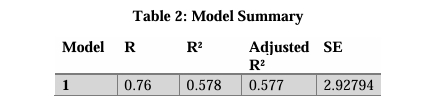

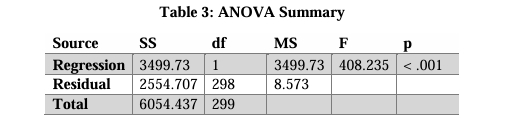

H3: Brand image has a mediating effect on the relationship between e-CRM and customer satisfaction.

H4: Customer satisfaction has a mediating effect between brand image and customer loyalty.

Theory

Relationship Marketing Theory is mainly concerned with the ongoing, long-term commitment and involvement between the business and the customers as opposed to single acts of buying and selling. This theory postulates that working on developing and strengthening customer relationships enables increasing customer loyalty and retention, which is crucial for a business’s long-term prosperity. It was developed in the early 1980s from services marketing (Berry, 1983) but has grown and expanded to focus on the key variables of customer satisfaction, trust, and commitment in maintaining such relationships.

They should incorporate the ideas that indicate that customers should be engaged with the aim of building trust, satisfaction, and excellent relational communication. Specifically, e-CRM (Electronic Customer Relationship Management) in the context of this model can be seen as an extension of Relationship Marketing which is enabled by Information Technology to allow better interaction between the bank and the customers. E-CRM systems enable organizations to gather information about customers, offer them differentiated experiences, and share customer information and strategies more efficiently. It makes it possible for banks to establish an intimate knowledge and appreciation of the needs and wants of customers, which is the key ingredient in relationship marketing. Referring to Relationship Marketing Theory, one learns that a business should always focus on the quality of communication with its customers.

By using this model, service quality is positioned as the mediator between the impacts of e-CRM and brand image. High service quality which has been enriched by efficient e-CRM assures the customers’ expectations to be fulfilled or exceeded, and, therefore, the overall brand image is improved. This goes well with the concept of relationship marketing which places much emphasis on satisfying the needs of the customer as a way of cementing the relational contract. Brand image in this model represents a summary of the overall impressions that consumers hold about the bank based on improved service contact influenced by e-CRM. A favorable brand image ensures that the customers become loyal through services that are pleasing and that are provided consistently and at the highest quality.

This is in line with Relationship Marketing Theory which holds that the consumers will remain loyal to the brand through the successive interactions that create a strong perception that the brand offers reliable and trustworthy services. The study established that brand image influences customer loyalty and the extent of this relationship is compounded by the consumer satisfaction- Mediation model. From the angle of Relationship Marketing Theory, satisfaction is one of the most important variables defining the strength of the established relationship. Loyal customer’s emotional commitment and beliefs about the brand are necessary for the formation of loyalty among the customers. According to this theory, even if

the brand image of a product is well established, the tangible experience, and overall consumer satisfaction level can either enhance the loyalty bond or inversely.

Through the inclusion of the Relationship Marketing Theory in this figure, we get a complete understanding of how technologies that focus on the management of customer relationships improve the quality of service and consequently the customer’s perception that leads to loyalty in the e-CRM model. The theory gives a strong foundation to justify why and how the extended and quality interaction through e-CRM not only enhances the brand image but also enhances customer satisfaction and customer loyalty, thus emphasizing more on relational approach over the transactional approach. Thus, this theoretical framing enhances the study’s contribution to the appreciation of the application of e-CRM in creating

sustainable customer relationships in the banking industry.

Research Methodology

Research Design

This research uses a quantitative approach to measure the effect of E-CRM on customer loyalty in the banking sector. The quantitative data was collected via a survey-based questionnaire.

Population of Study

The population for this study comprised customers who frequented visit the Islamabad and Rawalpindi branches of Alfalah Bank and MCB Bank during the research period. MCB Bank has a significant presence in Islamabad and Rawalpindi with a total of 20 branches in Islamabad and 26 branches in Rawalpindi. Bank Alfalah also has an extensive branch network. In Islamabad, there are 17 branches, while Rawalpindi hosts 11 branches The data was collected from 8 branches of MCB and 4 of Alfalah.

Sampling Technique and Unit of Analysis

Convenience sampling technique was utilized to gather data from different branches and customer demographics. The unit of analysis was individual customers who visited the specified branches during the data collection period.

Sample Size

Approximately 200 customers from each organization (Al-Falah Bank and MCB Bank) were surveyed, resulting in a total sample size of 400. Out of those 39 questionnaires were incomplete, 24 were not returned and 37 were pseudo responses. So, the remaining 300 were used for the analysis.

Measures and Instruments

To obtain data, the participants were given a structured questionnaire. Since the survey was designed to assess the effectiveness of e-CRM in the contexts of service quality, brand image, customer loyalty, and consumer satisfaction, the questionnaire was divided into five parts. Instruments were developed with 5-Likert scales to elicit specific and thorough viewpoints and experiences. Various parts were extracted from different studies. This approach is useful in the broader understanding of the effects that the system has on the perceived customer experiences.

Data collection procedure

Questionnaires were utilized and self-administered either on paper or through online platforms depending on the participant’s preference. They were given assurance of anonymity and they were freely asked questions that required genuine responses.

Time horizon

Data collection was extended for two weeks to ensure that it captured customers at different times and days of the week to increase the credibility of the responses.

Data analysis software

To analyze the quantitative data collected, the Statistical Package for the Social Sciences (SPSS) software was used due to its versatility in quantitative data analysis.

Data analysis technique

Descriptive statistics were employed in the analysis of the data, to provide a concise description of the demographic variables and the responses, which give an overall picture of the sample as well as the responses gathered. To check for the generalisability of the sample, demographic data regarding sex, age, level of education, and working place were collected and compared to the population parameters. To supplement the analysis, assumptions for regression were checked to ensure that the conditions that make it relevant were met such as linearity, equal variance, independence, and no multicollinearity in the data. Construct validity was checked through confirmatory factor analysis to determine the degree to which the eHROQ measures represented the constructs of interest and estimate inter-construct relationships and reliability analysis was conducted to ensure that the measures provided consistent results in terms of internal consistency and temporal stability, usually using the Cronbach’s alpha test. The construct validity test was used to establish the degree to which the questionnaire measures the intended variables in a study, and the conclusion was reached that the study has a good construct validity. For confirming normality, normality statistics were computed for the response and predictor variables to ensure that they met the assumption of normality which is required for the majority of statistical tests, including regression analysis. In this study, correlation analysis was adopted with a view of identifying the strength and direction of the relationship and helping provide direction on how certain factors relate to others. The technique of hypothesis testing (analysis of variance) used in the analysis involved testing specified hypotheses about the effects of predictor variables on the outcome variables, with regression analysis used to establish the nature of the relationships between independent and dependent variables. To understand the relationships between several variables, mediation, and moderation analysis, with the help of Preacher and Hayes macro, was conducted for mediators and moderators, which were identified to explain the mechanism of relationships and how these relationships are influenced by the intensity and direction.

Data Analysis & Results:

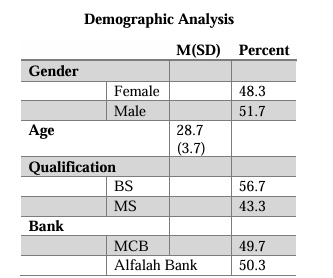

A demographic analysis was conducted to characterize the sample population. The sample consisted of 48.3% females and 51.7% males. Participants had a mean age of 28.7 years (SD = 3.7). In terms of educational qualifications, 56.7% of participants held a Bachelor of Science (BS) degree, while 43.3% held a Master of Science (MS) degree. Regarding consumerism, 49.7% of participants were consumers at MCB, and 50.3% were consumers at Alfalah Bank.

Descriptive Analysis

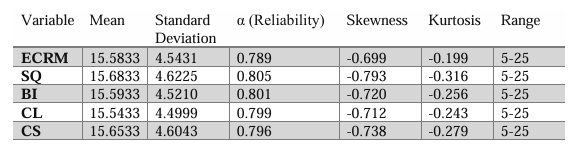

Descriptive statistics were calculated for the variables ECRM, SQ, BI, CL, and CS. The means ranged from 15.5433 to 15.6833, with standard deviations ranging from 4.49988 to 4.62251. Reliability estimates (α) for all variables were above 0.75, indicating good internal consistency. The range of scores varied from 5 to 25 across the variables. Skewness values ranged from -0.699 to -0.793, suggesting a slight negative skew in the distribution of scores. Kurtosis values ranged from -0.199 to -0.316, indicating a platykurtic distribution, which is slightly flatter than a normal distribution. See Table 2 for detailed descriptive statistics.

Correlation Analysis

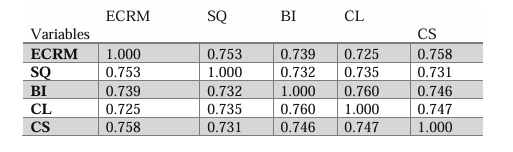

This table shows the correlation matrix for the variables ECRM, SQ, BI, CL, and CS. All correlations are significant at the 0.01 level (2-tailed). The strongest correlations were found between ECRM and SQ (r = .753, p < .01), ECRM and CS (r = .758, p < .01), and BI and CL (r = .760, p < .01). The correlations between other variables were also significant and ranged from r = .725 to r = .747 (p < .01). These findings indicate strong positive relationships between the variables, suggesting potential associations among them.

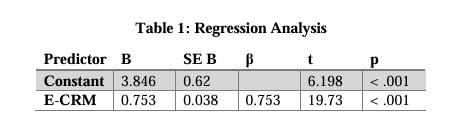

Note: B = unstandardized regression coefficient; SE B = standard error of the coefficient; β = standardized coefficient; t = t-test statistic; p = significance level.

This table displays the results of the regression analysis predicting the outcome variable. The model includes a constant (B = 3.846, SE = 0.620, t = 6.198, p < .001) and E-CRM as a predictor variable (B = 0.753, SE = 0.038, β = 0.753, t = 19.73, p < .001). E-CRM shows a significant positive relationship with the outcome variable, with a standardized regression coefficient (β) of 0.753 (p < .001), indicating that higher levels of E-CRM are associated with higher values of the outcome variable.

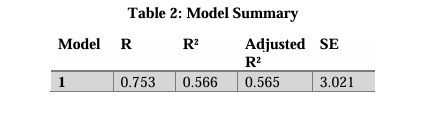

Note: R = multiple correlation coefficient; R² = coefficient of determination; Adjusted R² = adjusted coefficient of determination; SE = standard error of the estimate.

Table 2 presents the model summary for the regression analysis. The model shows a multiple correlation coefficient (R) of 0.753, indicating a moderate-to-strong positive relationship between the predictors and the outcome variable. The coefficient of determination (R²) is 0.566, meaning that 56.6% of the variance in the outcome variable can be explained by the predictor variables. The adjusted R², which considers the number of predictors in the model, is 0.565. The standard error (SE) of the estimate for the model is 3.021, indicating the average distance that the observed values fall from the regression line.

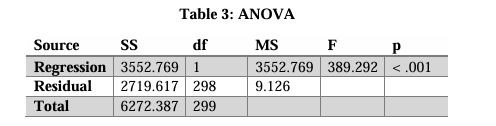

Note: SS = sum of squares; df = degrees of freedom; MS = mean square; F = F-test statistic; p = significance level.

Table 3 presents the results of the analysis of variance (ANOVA) for the regression analysis. The regression model significantly predicts the outcome variable, F(1, 298) = 389.292, p < .001. The regression model accounts for a significant amount of variance in the outcome variable, as indicated by the large F value (F = 389.292) and the highly significant p-value (p < .001). The model explains a substantial portion of the total variance in the outcome variable, with a regression sum of squares (SS) of 3552.769 compared to a residual SS of 2719.617. Overall, the model provides a good fit for the data.

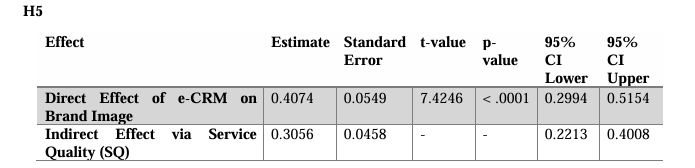

This table summarizes the direct and indirect effects of e-CRM on brand image. The direct effect of e-CRM on brand image is significant, with a coefficient (B) of 0.4074. The indirect effect of e-CRM on brand image, mediated by service quality (SQ), is also significant, with a coefficient of 0.3056. The completely standardized indirect effect, which accounts for the standard deviation of the mediator (SQ), is 0.3107. These results indicate that both the direct and indirect pathways through SQ significantly influence the relationship between e-CRM and brand image.

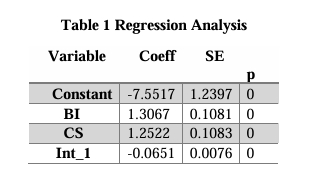

Table 1 displays the results of the regression analysis predicting the outcome variable. The model includes a constant and Brand Image as a predictor variable. Brand Image shows a significant positive relationship with the outcome variable, with a standardized regression coefficient (β) of 0.760 (p < .001), indicating that higher levels of Brand Image are associated with higher values of the outcome variable.

Table 2 presents the model summary for the regression analysis. The model (Model 1) shows a multiple correlation coefficient (R) of 0.760, indicating a strong positive relationship between the predictors and the outcome variable. The coefficient of determination (R²) is 0.578, meaning that 57.8% of the variance in the outcome variable can be explained by the predictor variables. The adjusted R², which considers the number of predictors in the model, is 0.577. The standard error (SE) of the estimate for the model is 2.92794, indicating the average distance that the observed values fall from the regression line.

Table 3 presents the results of the analysis of variance (ANOVA) for the regression analysis. The regression model significantly predicts the outcome variable, F(1, 298) = 408.235, p < .001. The regression model accounts for a significant amount of variance in the outcome variable, as indicated by the large F value (F = 408.235) and the highly significant p-value (p < .001). The model explains a substantial portion of the total variance in the outcome variable, with a regression sum of squares (SS) of 3499.73 compared to a residual SS of 2554.707. Overall, the model provides a good fit for the data.

Table 1 presents the results of the regression analysis predicting the outcome variable. The model includes a constant, Brand Image (BI), Customer Satisfaction (CS), and an interaction term (Int_1). All predictors are statistically significant, indicating that Brand Image, Customer Satisfaction, and their interaction significantly predict the outcome variable.

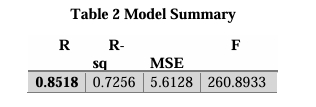

Table 2 presents the model summary for the regression analysis. The model shows a strong multiple correlation coefficient, indicating a good fit of the predictors with the outcome variable. The coefficient of determination suggests that 72.56% of the variance in the outcome variable can be explained by the predictors. The mean squared error and the F-value both indicate that the model is statistically significant, demonstrating that the predictors collectively contribute to predicting the outcome variable.

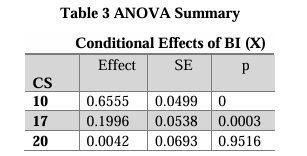

Table 3 presents the ANOVA summary for the conditional effects of Brand Image (BI) on Customer Satisfaction (CS). The table shows the effects of Brand Image at different levels of Customer Satisfaction. For Customer Satisfaction levels 10 and 17, the effects of Brand Image are significant. However, at Customer Satisfaction level 20, the effect of Brand Image is not significant. This indicates that the impact of Brand Image on the outcome variable (not explicitly stated here) depends on the level of Customer Satisfaction.

Table H5 summarizes the direct and indirect effects of e-CRM on Brand Image. The direct effect of e-CRM on Brand Image is significant, with an estimate of 0.4074. The indirect effect of e-CRM on Brand Image via Service Quality (SQ) is also significant, with an estimate of 0.3056. These results indicate that both the direct path and the path through SQ significantly influence the relationship between e-CRM and Brand Image.

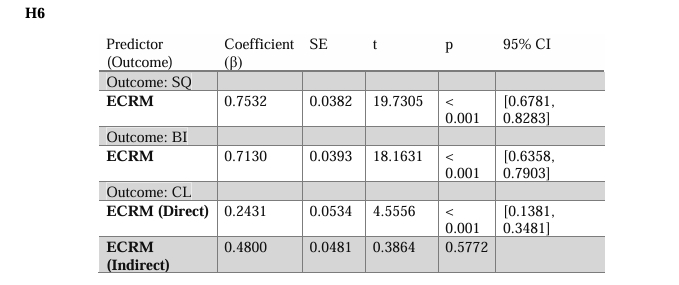

This table summarizes the regression analysis results for the relationships between predictors (ECRM, SQ, BI, and CL) and the outcome variables (SQ and BI). For the outcome variable SQ, ECRM has a significant positive coefficient. Similarly, for the outcome variable BI, ECRM shows a significant positive relationship. For CL as an outcome variable, ECRM has a smaller, but still significant, positive coefficient. The second part of the table summarizes the direct and indirect effects of ECRM on Customer Loyalty (CL). The direct effect of ECRM on CL is significant, with an estimate of 0.2431. The total indirect effect of ECRM on CL, mediated through other variables (not specified here), is 0.4800. The results indicate that while there is a significant direct effect of ECRM on CL, the total indirect effect through other pathways is not statistically significant.

Discussion

The study explored the impact of Electronic Customer Relationship Management (e-CRM) on service quality, and how this influences brand image and customer loyalty, with consumer satisfaction as a moderating variable, in the banking and retail sectors of Islamabad and Rawalpindi. Chen and Huang (2022), prove that the brand image is the key element in the creation of customer loyalty. The research by Kim and Park (2021) indicates that high service quality in the form of the reliability, responsiveness, and personalization of services results in increased customer satisfaction with the services and hence, enhanced customer retention rates. The findings suggest that effective implementation of e-CRM significantly enhances service quality, which in turn positively affects the brand image. Zhao et al. (2021) proved that superior service quality which is accomplished through the effective use of CRM systems has a strong effect on customer satisfaction and loyalty, thus, service quality is a vital mediator in the technology-customer loyalty linkage. This enhanced brand image was shown to lead to greater customer loyalty, especially when consumer satisfaction levels were high, underscoring the importance of integrating e-CRM with customer satisfaction initiatives to maximize loyalty.

Limitations

This study also had some limitations that can be highlighted as follows; It was a cross-sectional study, which reveals information at one specific time. This design also limits the possibility of establishing clear cause-and-effect relationships between e-CRM implementation and corresponding changes in customers’ loyalty levels. Furthermore, the sample group was restricted to customers from the two cities of Islamabad and Rawalpindi only, and therefore the results may not reflect the experiences of customers in other regions.

Future direction

As for the research limitations, it is suggested that future research should focus on longitudinal research designs to capture the dynamic changes of e-CRM and investigate the causal effects as well as the durability of the yielded service quality improvements, brand image enhancements, and customer loyalty increases. As for the venues, broadening the geographical representation to capture a wider range of settings would improve the external validity of the conclusions. Furthermore, the use of qualitative data collection techniques could provide a further understanding of customer attitudes and feedback concerning e-CRM systems.

Implications

It has profound practical implications for the banking sector as well as the retailing industry. Effective e-CRM implementation means putting in place sound and effective e-CRM systems that will lead to better service delivery, thereby increasing the positive impressions that customers have of the brand. Many e-CRM solutions have been put into practice by business organizations and what is most important is to maintain and update these solutions to fit into the ever-changing customer needs and demands. In addition, comprehending the position of consumer satisfaction in this process enables the managers to develop actions that result in satisfaction and hence, consumer loyalty.

Conclusion

From this paper, insights were gained on the benefits of e-CRM on service quality and the resultant effects on brand image and customer loyalty within the banking and retail industry. In affirming the mediating influence of consumer satisfaction, the study underscores the centrality of e-CRM strategies and the importance of enhancing the satisfaction of consumers through the appropriate improvement and the application of diverse consumer satisfaction strategies. As highlighted in the research timeline outlined above, the efficient completion of the study was made possible through following this structure of work, The findings of the research then have theoretical relevance and implications to the field of business management as well as useful applications in the formulation of business strategies.

References

Bala, M., & Verma, D. (2020). Perceived Value, Service Quality, And Customer Satisfaction: Evidence From Banking. Services

Marketing https://doi.org/10.1080/15332969.2020.1713177 Quarterly, 41(2), 138-156.

Chen, J., & Huang, Y. (2022). Exploring The Impact Of Brand Image On Customer Loyalty And Commitment: Role Of Customer Satisfaction. Journal of Retailing and Consumer Services, 63, Article 102674. https://doi.org/10.1016/j.jretconser.2021.102674

Hayes, A. F. (2022). Introduction To Mediation, Moderation, And Conditional Process Analysis: A Regression-Based Approach (3rd edition). New York: The Guilford Press.

Hameed, F. (2013). The Effect of Advertising Spending on Brand Loyalty Mediated by Store Image, Perceived Quality and Customer Satisfaction: A Case of Hypermarkets. Asian Journal of Business Management, 5(1), 181-192. http://dx.doi.org/10.19026/ajbm.5.5827

Hameed, F., Malik, I. A, Hadi. N. U., & Raza, M. A. (2023). Brand awareness and purchase intention in the age of digital communication: A moderated mediation model of celebrity endorsement and consumer attitude. Online Journal of Communication and Media Technologies, 13(2), e202309. https://doi.org/10.30935/ojcmt/12876

Hossain, M. A., Leo, G., & Ali, F. (2020). The Mediating Role Of Customer Satisfaction Between Service Quality And Customer Loyalty In Malaysian E-Commerce. Journal of Retailing and Consumer Services, 55, Article 102122. https://doi.org/10.1016/j.jretconser.2020.102122

Pacific Kaur, H., & Quareshi, T. K. (2021). Impact Of Brand Image On Buying Behaviour Among Teenagers. Asia Journal

of Marketing https://doi.org/10.1108/APJML-03-2020-0179 and Logistics, 33(4), 869-885.

Kim, J., & Kim, J. (2020). The Impact Of Customer Satisfaction On Repurchase Intentions In The Fast Fashion Industry. International Journal of Retail & Distribution Management, 48(5), 487-502. https://doi.org/10.1108/IJRDM-08-2019-0256

Kim, J., & Park, J. (2021). Examining The Effects Of Customer Satisfaction On Loyalty And The Mediating Role Of Service Quality In The Fast-Food Industry. International Journal of Hospitality Management, 92, Article 102703. https://doi.org/10.1016/j.ijhm.2020.102703

Lee, J., & Lee, Y. (2020). The Interactions Of CSR, Self-Congruity, And Purchase Intention Among Chinese Consumers.

Australasian Marketing https://doi.org/10.1016/j.ausmj.2019.05.003 Journal (AMJ), 28(1), 57-66.

Lu, H., Papagiannidis, S., & Alamanos, E. (2020). Customer Relationship Management In The Era Of Digital Platforms.

Journal of https://doi.org/10.1016/j.jbusres.2020.09.028 Business Research, 121, 634-642.

Ngo, V. D., Nguyen, H. N., & Cao, T. K. (2021). The Influence Of E-CRM On Customer Satisfaction: Mediators Of Perceived Value And Brand Image. Computers in Human Behavior, 114, Article 106553. https://doi.org/10.1016/j.chb.2020.106553

Sharma, N., & Nayyar, R. (2020). Service Quality And Its Impact On Customer Satisfaction In Indian E Commerce. International Journal of Quality & Reliability Management, 37(8), 1263-1280. https://doi.org/10.1108/IJQRM-08-2019-0245

Singh, J., Crisafulli, B., & Quamina, L. T. (2021). Corporate Branding, Emotional Attachment And Brand Loyalty: The Case Of Luxury Fashion Branding. Journal of Business Research, 130, 445-456. https://doi.org/10.1016/j.jbusres.2020.11.028

Tajvidi, M., Richard, M.-O., Wang, Y., & Hajli, N. (2020). Brand Co-Creation Through Social Commerce Information Sharing: The Role Of Social Media. Journal of Business Research, 121, 476-486. https://doi.org/10.1016/j.jbusres.2020.08.028

Tang, L., Li, H., & Men, R. (2020). How Digital Marketing Enhances The Effectiveness Of Brand Image: The Mediating Role Of Consumer Engagement. Journal of Retailing and Consumer Services, 55, Article 102207. https://doi.org/10.1016/j.jretconser.2020.102207

Zhang, X., Li, S., & Liu, S. (2020). Service Quality, Technology Alignment, And Consumer Satisfaction: Evidence From The Financial Industry. Service Industries Journal, 40(7-8), 503-525. https://doi.org/10.1080/02642069.2019.1634675

Zhao, Y., Wang, L., Tang, H., & Zhang, Y. (2021). Service Quality In The Digital Era: The Role Of E CRM Capabilities In Enhancing Customer Satisfaction And Loyalty. Journal of Business Research, 128, 187-197. https://doi.org/10.1016/j.jbusres.2021.02.030

Zhu, Y., & Chen, Y. (2020). The Impact Of Green Brand On Brand Image And Brand Loyalty. Business Strategy and the Environment, 29(6), 2375-2384. https://doi.org/10.1002/bse.2555